[ad_1]

Market strategists warn that a robust global economic rebound is driving an intense surge in commodity prices throughout 2024. This surge poses a challenge to the Federal Reserve’s efforts to contain inflation and could complicate its plans to cut interest rates by mid-year.

From oil and gasoline to gold and silver, commodities have kicked off the year with remarkable gains, reaching levels unseen for years. This rally has reignited concerns about inflation among investors and raised fears that the Federal Reserve might need to maintain higher borrowing costs for a longer duration than initially anticipated.

The Bloomberg Commodity Index, tracking 24 major commodities futures contracts across energy, metals, and crops, reached its highest point since November, largely fueled by surging energy and gold prices.

This spike is partly attributed to escalating geopolitical tensions in the Middle East and the ongoing conflict between Russia and Ukraine, as well as speculations that the first rate cut by the Fed might not occur until summer.

Silver has also witnessed a notable uptrend, with the iShares Silver Trust recording its strongest performance since May 2023. This surge in precious metals has defied expectations, even in the face of a strengthening U.S. dollar.

Nanette Abuhoff Jacobson, global investment strategist at Hartford Funds, explains that the market is anticipating better-than-expected global growth, along with increased inflation and commodity prices. This scenario complicates the Fed’s goal of implementing three rate cuts in 2024 as initially planned.

Amidst this backdrop, U.S. Treasury yields have risen, with the 10-year Treasury bond yield reaching its highest level since November. Oil prices have been a significant driver, climbing towards $90 per barrel, buoyed by both geopolitical tensions and expectations of heightened demand due to strong economic growth.

However, some analysts, like Stephen Lee from Logan Capital Management, suggest that the primary driver behind the oil price surge is not geopolitical conflicts but rather expectations of robust economic growth globally.

The positive correlation between oil prices and energy stocks indicates a shift in oil supply and demand dynamics, according to Nicholas Colas of DataTrek Research. This suggests that energy stocks may be poised for further gains.

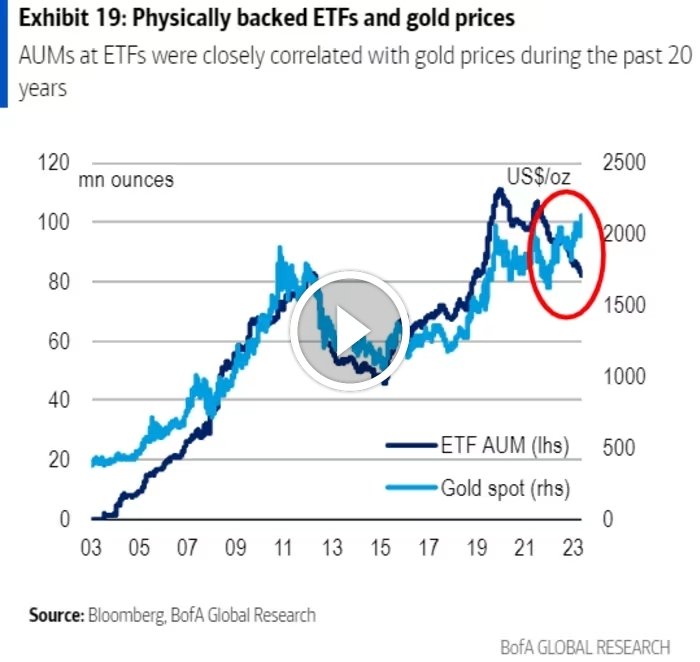

Despite the strength of the U.S. dollar, precious metals continue to maintain their ground due to rising physical demand, driven by various factors including geopolitical tensions and uncertainties surrounding Fed rate cuts.

The traditional inverse correlation between the U.S. dollar and commodities, particularly gold, has weakened recently, as both have experienced increased demand amid global economic uncertainties. Oil, being priced in dollars globally, typically exhibits an inverse relationship with the dollar.

[ad_2]

Source link