[ad_1]

Market Overview: Crude Oil Futures

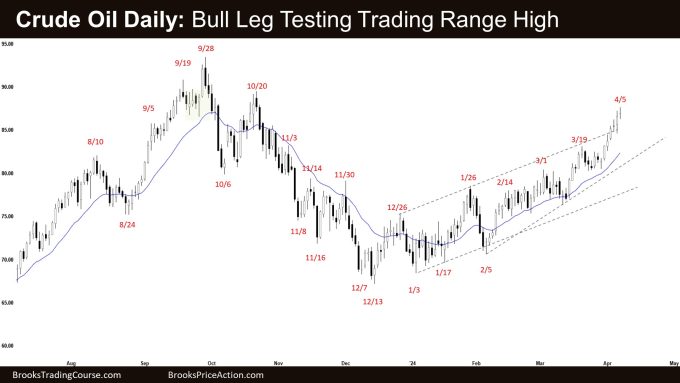

The bulls managed managed to create consecutive bull bars closing near their highs which means stronger Crude Oil buying pressure. They want a retest of the trading range high (Sept 28). The bears need to create consecutive bear bars closing near their lows to convince traders that they are back in control.

Crude oil futures

The Weekly crude oil chart

- This week’s candlestick on the weekly Crude Oil chart was a bull bar closing near its high.

- Last week, we said that the odds slightly favor the market to remain in the bull channel.

- This week broke out from the bull channel as the bull continued to build more buying pressure (consecutive bull bars closing near their highs).

- The bears see the recent sideways to up pullback as forming a wedge bear flag (Dec 26, Jan 29, Apr 5).

- They want a failed breakout above the bull channel.

- While the bears have a wedge pattern, they have not been able to create strong selling pressure with follow-through selling since the pullback started in December.

- They will need to create consecutive bear bars closing near their lows to convince traders that they are back in control.

- The bulls see the selloff to the December 13 low simply as a bear leg within a trading range.

- They got a weak bull channel with overlapping candlesticks trading above the 20-week EMA for weeks.

- While the move up has a lot of overlapping candlesticks, the bulls have created stronger buying pressure (bull bars closing near their highs) against weaker selling pressure (bear bars had no follow-through selling).

- The market has further strengthened in the last few weeks with bull bars closing near their highs and breaking above the bull channel.

- If the market trades lower (pullback), the bulls want the 20-week EMA or the bull trend line to act as support.

- Since this week’s candlestick is a bull bar closing in its upper half, it is a buy signal bar for next.

- For now, the odds slightly favor the market to remain in the bull channel with pullbacks in between.

- The market is trading near the upper third of the trading range, which is the sell zone of the trading range traders.

- Traders will see if sellers appear around this area, or higher up in the trading range.

- The inability of the bears to create meaningful follow-through selling pressure has increased the odds of the bull leg testing the upper third or the trading range high area.

The Daily crude oil chart

- Crude Oil traded sideways to up for the week.

- Previously, we said that the odds slightly favor any pullback to be minor and the bull channel to continue. If the bulls can get a few strong consecutive bull bars breaking above the bull channel, it can swing the odds of the bull leg beginning.

- The bulls hope that the bull leg to retest the trading range high (Sept 28) is currently underway.

- If the market trades lower (pullback), they want the pullback to be weak and shallow and the 20-day EMA or the bull trend line to act as support.

- The bear sees the current pullback as forming a wedge bear flag (Dec 26, Jan 26, and Apr 5). They also see an embedded wedge forming in the third leg up (Mar 1, Mar 19 and Apr 5).

- They see the move up simply as a bull leg within a trading range and a buy vacuum test of the trading range high area.

- The problem with the bear’s case is that the selling pressure continues to be weak (poor follow-through selling) while the buying pressure is becoming stronger (stronger consecutive bull bars closing near their highs).

- They need to create strong consecutive bear bars trading far below the 20-day EMA and the bear trend line to increase the odds of lower prices.

- For now, the move up is strong enough to favor at least a small second leg sideways to up after a pullback.

- The bull leg to retest near the trading range high may be underway.

- The market is also trading near the upper third of the trading range, which can be the sell zone of trading range traders.

- Traders will see if sellers appear aggressively here, and if not, then the next area to watch for is around the September 8 high area,

- The inability of the bears to create meaningful follow-through selling pressure has increased the odds in favor of more sideways to up movements. This remains true.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.

[ad_2]

Source link