[ad_1]

On Friday, U.S. stock-index futures decreased slightly after a strong rally fueled by the success of chipmaker Nvidia, which sparked excitement about the potential for an artificial-intelligence breakthrough.

What’s happening

- Futures for the Dow Jones Industrial Average decreased by 5 points to 39,118, a drop of 0.12%.

- S&P 500 futures ES00 fell by 2 points, representing a drop of 0%, to reach 5096.

- Nasdaq-100 futures (NQ00, -0.13%) dropped by 27 points, or 0.2%, to 18021.

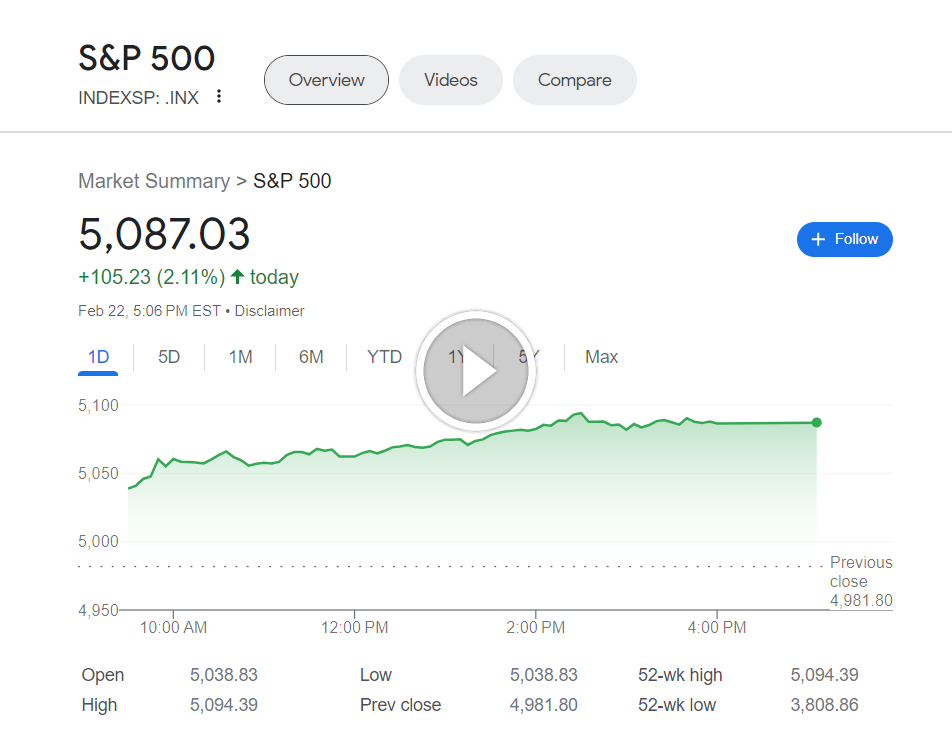

The Dow Jones Industrial Average increased by 457 points on Thursday, representing a 1.18% rise to reach 39069. The S&P 500 also saw a significant increase of 105 points, or 2.11%, reaching 5087. Additionally, the Nasdaq Composite gained 461 points, or 2.96%, reaching 16042.

The S&P 500 achieved its 12th highest close of the year, while the Nasdaq Composite came within 0.1% of reaching a new record.

Despite facing challenges, small-cap stocks also increased, with the Russell 2000 index rising by 1%.

What’s driving markets

Nvidia will continue to receive attention on Friday following a 16% increase in their stock price on Thursday due to exceeding analyst expectations with their fourth quarter revenue and first quarter sales outlook. This surge has now made Nvidia the third most valuable stock in the S&P 500, surpassing both Alphabet and Amazon.com.

Investors paid attention to Nvidia CEO Jensen Huang’s declaration that AI had reached a critical turning point.

Mark Haefele, the chief investment officer of UBS Global Wealth Management, believes that generative AI will be the dominant trend in the coming years and Nvidia’s earnings report highlights the current robust spending on AI infrastructure.

In a speech given by Federal Reserve Governor Lisa Cook after the stock market closed on Thursday, she mentioned that it will take a while for AI to have a significant impact on productivity. Cook noted that historical patterns suggest that progress from the invention of general-purpose technologies to seeing improvements in productivity can be a slow and unpredictable process. She also emphasized that while the adoption of generative AI is occurring quickly, fully benefiting from the technology will also require additional investments and changes in corporate practices, management approaches, and worker training.

Cook stated that the current monetary policy is tight, but expressed the desire for more certainty that inflation will reach the target of 2% before considering a reduction in interest rates.

Federal Reserve Governor Christopher Waller also emphasized in a speech on Thursday, delivered after the stock market had closed, that he anticipates it will be suitable to start easing monetary policy sometime this year. However, he noted that the timing and extent of policy easing will be determined by new economic data.

Several more companies will be releasing their earnings reports soon, including Warner Bros. Discovery and Icahn Enterprises. Intuitive Machines saw a boost in its stock price before the market opened after its spacecraft successfully landed on the moon and began transmitting signals back to Earth.

[ad_2]

Source link