[ad_1]

Market Overview: Crude Oil Futures

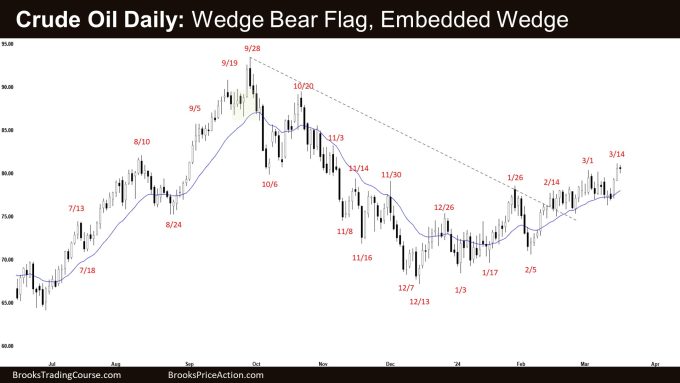

There was no follow-through selling in Crude Oil on the weekly chart, forming an outside bull bar closing near its high. If the bulls can create more follow-through buying, it can swing the odds in favor of the bull leg beginning. The bears see the recent sideways to up pullback as forming a wedge bear flag (Dec 26, Jan 29, Mar 14). They also see an embedded wedge forming in the third leg up (Feb 14, Mar 3, and Mar 14).

Crude oil futures

The Weekly crude oil chart

- This week’s candlestick on the weekly Crude Oil chart was an outside bull bar closing near its high.

- Last week, we said that the odds slightly favor a breakout below the ioi (inside-outside-inside) first. The first breakout can fail 50% of the time. Traders will see if the bears can create a follow-through bear bar.

- This week broke below the inside bear bar but reversed to break above the inside bar after that.

- The bears see the recent sideways to up pullback as forming a wedge bear flag (Dec 26, Jan 29, Mar 14). They also see an embedded wedge forming in the third leg up (Feb 14, Mar 3, and Mar 14).

- They want another leg down to retest the prior leg low (Dec 13).

- They will need to create sustained follow-through selling closing below the 20-week EMA. So far, they have not yet been able to do so.

- The bulls see the selloff to the December 13 low simply as a bear leg within a trading range.

- They got a reversal from a higher low major trend reversal (Dec 13), a wedge bull flag (Oct 6, Nov 16, and Dec 13) and a small double bottom bull flag (Jan 13 and Feb 5).

- They will need to create sustained follow-through buying above the 20-day EMA and the January high to increase the odds of the bull leg beginning.

- If the market trades lower, they want a reversal from a higher low major trend reversal.

- So far, the market has been trading above the 20-week EMA, albeit not very strong (overlapping candlesticks with alternating bull and bear bars).

- It is in a tight trading range with a slight tilt up (therefore a bull channel and a bear flag).

- Since this week’s candlestick is a bull bar closing near its high, it is a buy signal bar for next week.

- The inability of the bears to create meaningful follow-through selling is slowly swinging the odds in favor of more sideways to up movements.

- If the bulls can create a follow-through bull bar, it will increase the odds of the bull leg beginning.

- Poor follow-through and reversals are the hallmarks of a tight trading range.

- Side note: Some news events over the weekend about the Ukraine-Russia conflict (possibly affecting oil output) can cause prices to be volatile.

The Daily crude oil chart

- Crude Oil traded lower earlier in the week but lacked sustained follow-through selling below the 20-day EMA. The market then reversed to break above the January and the March 1 highs.

- Last week, we said that the minor pullback (sideways to up) phase can end if the bears can create sustained follow-through selling closing below the 20-day EMA.

- The bulls see the move down to December 13 simply as a bear leg within a trading range.

- They got a reversal from a wedge pattern (Oct 6, Nov 16, and Dec 13) and a double bottom bull flag (Dec 13 and Feb 5).

- They hope to get a breakout above the January high followed by the beginning of the bull leg to retest the September high.

- The bulls will need to create consecutive bull bars closing near their highs, trading far above the January high to increase the odds of the bull leg beginning.

- If the market trades lower, they want a reversal from a higher low major trend reversal.

- The bear sees the current pullback as forming a wedge bear flag (Dec 26, Jan 29, and Mar 14). They also see an embedded wedge forming in the third leg up (Feb 14, Mar 3, and Mar 14).

- They want the market to stall around the January high area or slightly above it and a retest of the December low after the current pullback.

- The problem with the bear’s case is that follow-through selling has been weak.

- They need to create meaningful selling pressure (strong consecutive bear bars) trading below the 20-day EMA to increase the odds of the retest of the December low.

- For now, traders will see if the bulls can get a sustained breakout above the January high or will the market continue to be in a tight trading range with a slight tilt up.

- If the market remains in the sideways bull channel, the odds of at least a small leg retesting the December low after the pullback will increase.

- However, if the bulls can get a few strong consecutive bull bars, it can swing the odds of the bull leg beginning.

- Poor follow-through and reversals are the hallmarks of a trading range.

- Side note: Some news events over the weekend about the Ukraine-Russia conflict (possibly affecting oil output) can cause prices to be volatile.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.

[ad_2]

Source link