[ad_1]

Market Overview: DAX 40 Futures

DAX futures moved higher last week with a measured move overshoot from a bull bar with tails above and below. The bears have nothing on the weekly so more up likely. The daily chart is starting to show signs of trading range action but expect buyers at 18000 and the moving average. The first break of this tight channel is also likely to find buyers so always in long.

DAX 40 Futures

The Weekly DAX chart

- The DAX 40 futures rose last week with a measured move overshoot above 18000.

- It was a bull bar with tails above and below, likely a channel on a lower timeframe.

- The bulls see a strong spike and a second leg. We are in a bull microchannel, with no lows below the low of a prior bar, so this leg has not ended.

- Some bulls might look at the last weeks, the tight trading range and subdivide it there. Using a volatility contraction as the end of the leg.

- There are two large legs. The last leg has two pauses, and this is the third part. So we should start to go sideways soon.

- We might go higher earlier in the week and return to the tight trading range and 18000. I think this is more than 60% likely.

- Bears have no signal bar yet but were able to sell above prior bars and make money. So starting to show signs of a trading range.

- Always in long so traders are long or flat.

- Most always in bulls will exit below a decent bear bar closing below its midpoint.

- Although it is BTC—Buy The Close after 5 bars in a row, it is usually better to wait for a pullback.

- Bears want a deeper pullback to the high of the prior trading range at 17495. This is where the moving average is now. It is also the prior ATH where we printed the double top. So a test of this is likely before continuing much higher

- That will likely be later in the year.

The Daily DAX chart

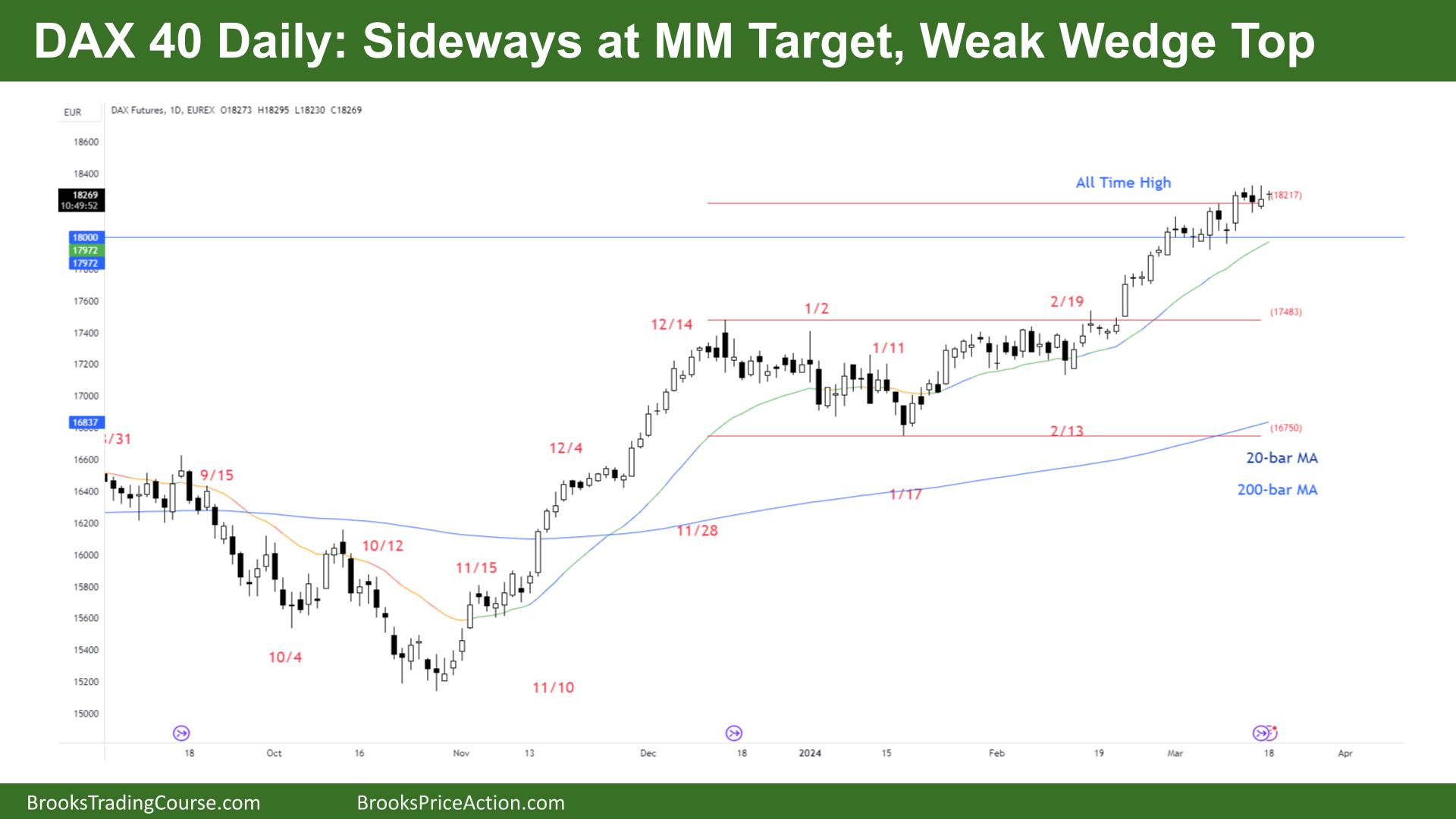

- The DAX 40 futures went sideways at the end of last week in a tight trading range at a measured move target.

- We are starting to trigger below bear bars on this chart, so the trend might shift into a trading range.

- But bears haven’t gotten a good signal or entry bar yet. So, there is still a small pullback bull trend until a wedge top triggers.

- Most traders should avoid trading wedge reversals in a strong, always-in environment. They fail a lot and usually make you miss entries that are easier to manage profitably.

- The inside bar is sideways, so we will likely form a final flag here, or it was a little below here last week.

- Not a great entry bar for bulls above, so likely buyers below.

- If you look at a strong leg, and it has three clear pauses like this one—think parabolic wedge. So expect two legs sideways and then trend resumption.

- The moving average is around 18000 big round number so expect that to be a magnet soon as well.

- The High 2 at 18000 was a weak signal bar, a bad buy that worked, so I expect we will test that this week or next.

- Always in long, so better to be long or flat. Expect sideways to up next week unless good signal bars for bears develop.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.

[ad_2]

Source link