[ad_1]

Market Overview: Bitcoin

The Bitcoin weekly chart shows a late-stage bull breakout, which raises concerns about a potential trend shift, either to sideways trading or a reversal. Bears might short here, while bulls are cautious.

The daily chart action paints a different picture. Stuck in a bull channel without a clear Always In signal, short-term choppiness is expected. Bulls can look for “high 2” or “high 3” setups within the channel, while bears should wait for confirmation of a reversal pattern before entering short positions. Dive deeper into the report for a comprehensive breakdown!

Bitcoin

The prices depicted on our charts are sourced from Coinbase’s Exchange Spot Price. It’s crucial to note that the spot price of Bitcoin is continuously in motion; trading activity never ceases. This means that market fluctuations and price changes occur around the clock, reflecting the dynamic nature of cryptocurrency trading.

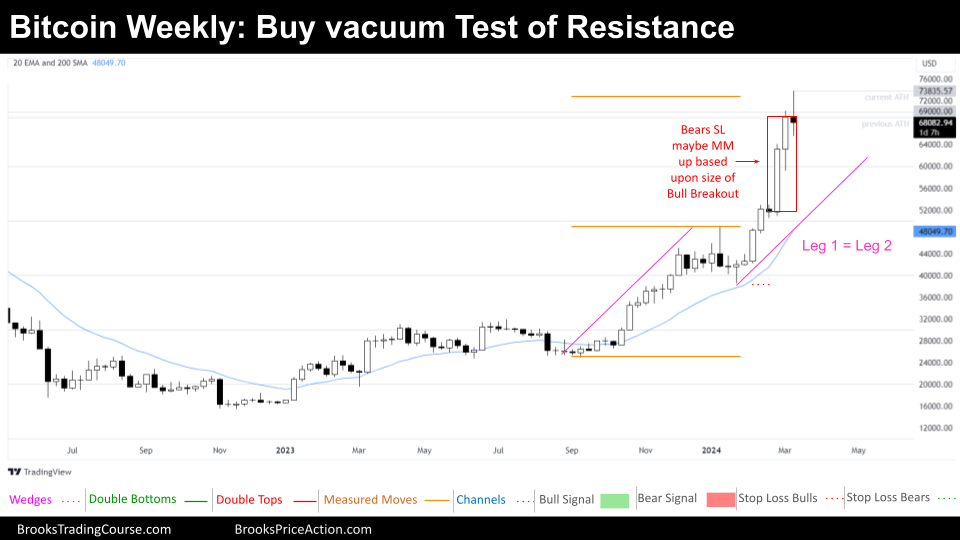

The Weekly chart of Bitcoin

The overall trend leans bullish because there is an Always in Long market contained within a bull breakout market cycle. However, the timing of this breakout raises eyebrows.

Such late-stage bull breakouts (20 or more bars into a bull trend) are buy vacuum tests of resistance. The late bull breakout might propel Bitcoin higher and create a stronger bull trend, however, a shift in the market cycle is more likely. This shift could be a trading range, or a reversal.

Remember that every turning point in a bull trend, whether a reversal or a test of strength, happens at resistance.

Aggressive bears can short the close of a weak bull follow-through week, like the current one. Their Stop Loss is based upon the height of the bull breakout (see chart), and their target is the low of the bull breakout (many will just take a $3000 to $5000 “scalp”). Other Bears will wait to sell below a reversal down. Conservative bears will wait for bull weakness, and will wait for a Lower High Major Trend Reversal pattern before entering a short position.

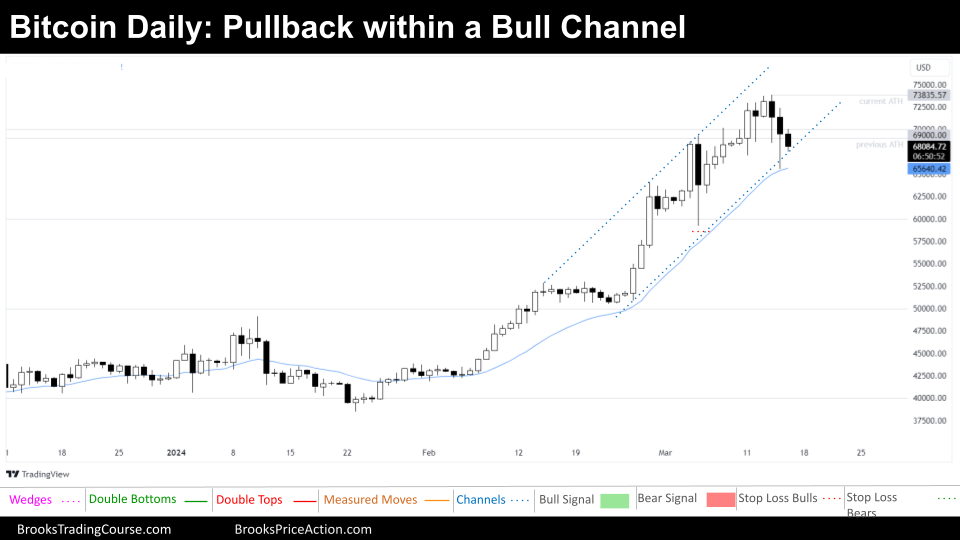

The Daily chart of Bitcoin

We’re currently in a bull channel, but either Always in Long or Always in Short market are absent. This suggests short-term sideways trading is more likely than a strong directional move.

For bulls, a pullback within the bull channel presents a potential buying opportunity. Expecting continued upward momentum contradicts the higher timeframe analysis. However, traders should trade what they see, and bulls should keep their focus on setups. They will look to trade a “high 2” or a “high 3” setup, specially if those have a large bullish candle body and the market is not Always in Short when that conditions are met. These bull setups are traded as scalps; nevertheless, a trader may leave a small portion of the trade running, trying to catch another swing up within the bull trend.

Bears, on the other hand, should exercise caution. They need confirmation of a reversal pattern before entering short positions. A reversal pattern can look like a tight trading range, a double top, or a head and shoulders top. Waiting for an Always in Short after the reversal pattern confirmation is ideal for bearish plays.

If the market transitions into a broader Trading Range, bulls will buy at the bottom third and bears will sell at the upper third.

What are your thoughts? Share your thoughts in the comments below and let’s get a discussion going! We appreciate any insights you may have regarding the price action framework. Remember, some of the most valuable contributions come from you, so don’t hesitate to share your knowledge!

Market analysis reports archive

You can access all the weekend reports on the Market Analysis page.

[ad_2]

Source link