[ad_1]

US stock indexes surged to new heights on Wednesday following the Federal Reserve’s decision to maintain interest rates and uphold its projection of three rate cuts this year.

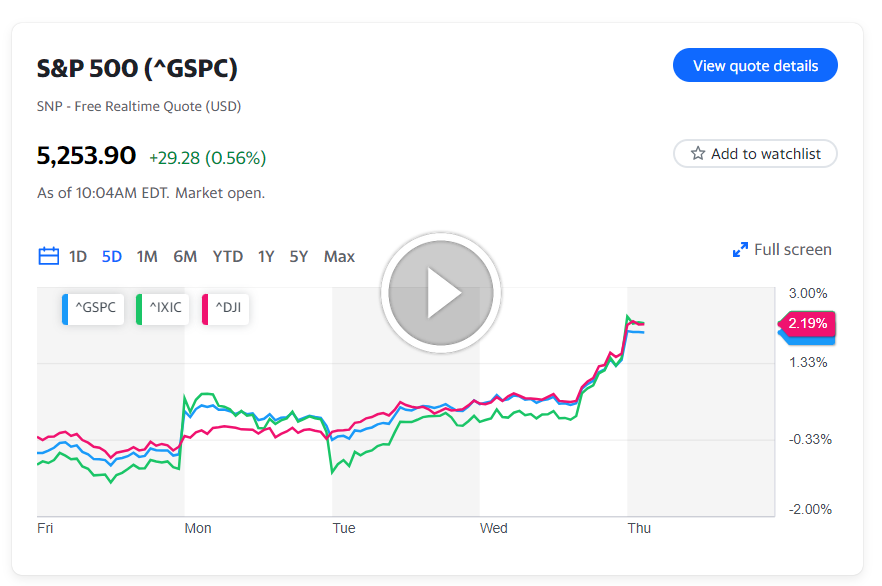

The S&P 500 (^GSPC) climbed by 0.8%, reaching a historic close above 5,200 at 5,224.62. Simultaneously, the Dow Jones Industrial Average (^DJI) surged approximately 1%, achieving a record closing of 39,512. Leading the charge was the Nasdaq Composite (^IXIC), dominated by tech stocks, which soared over 1% to culminate at a new high of 16,369.

All three major indices rebounded from marginal declines prior to the Fed’s announcement.

Accompanying its policy statement, the Fed disclosed updated economic projections in its Summary of Economic Projections (SEP), notably including its “dot plot” illustrating policymakers’ anticipated interest rate trajectories.

Fed officials anticipate the fed funds rate to decrease to 4.6% by the conclusion of 2024, suggesting a potential 0.75% reduction this year, in alignment with market expectations leading into Wednesday.

Despite the news, bond markets exhibited minimal movement, with yields on the 10-year Treasury (^TNX) experiencing slight decreases to approximately 4.28%, following a notable increase of over 20 basis points over the past fortnight.

Overall, the market’s response to the Fed meeting underscored a widening participation in the market rally, with the small-cap benchmark index (^RUT) surging nearly 2%, and six out of the 11 S&P 500 sectors rallying by more than 1%.

[ad_2]

Source link