[ad_1]

A top strategist at Bank of America is cautioning that the U.S. economy is shifting from a ‘Goldilocks’ scenario to one resembling the stagflation of the 1970s, where inflation persists amid slowing economic growth. Michael Hartnett emphasizes that investors should take this transition seriously to avoid potential pitfalls.

Stagflation, characterized by high inflation coupled with stagnant economic growth, plagued the U.S. economy in the 1970s and early 1980s. Recent indicators suggest a similar pattern emerging, with inflationary pressures mounting while economic momentum wanes.

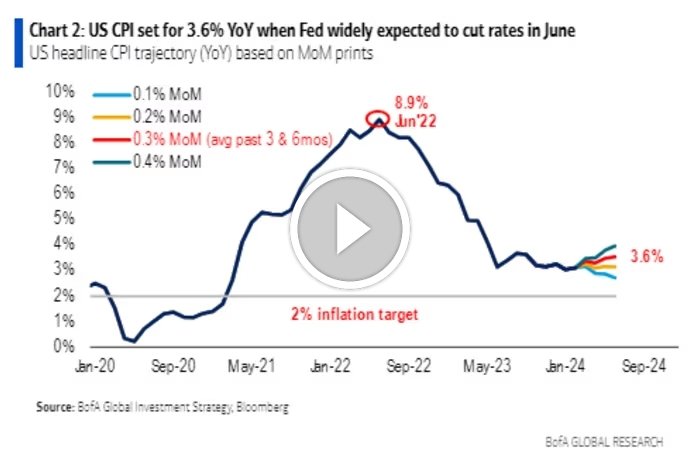

Recent data reveals a concerning trend: inflation rates exceeding expectations, with consumer prices surging by 3.2% over the past year and projected to reach 3.6% by June. This has led traders to anticipate the possibility of the Federal Reserve cutting interest rates for the first time since 2022.

The inflationary trend extends globally, prompting some emerging-market central banks to halt interest rate cuts. Meanwhile, signs of labor market weakness are surfacing, threatening the previously robust economic growth in the U.S.

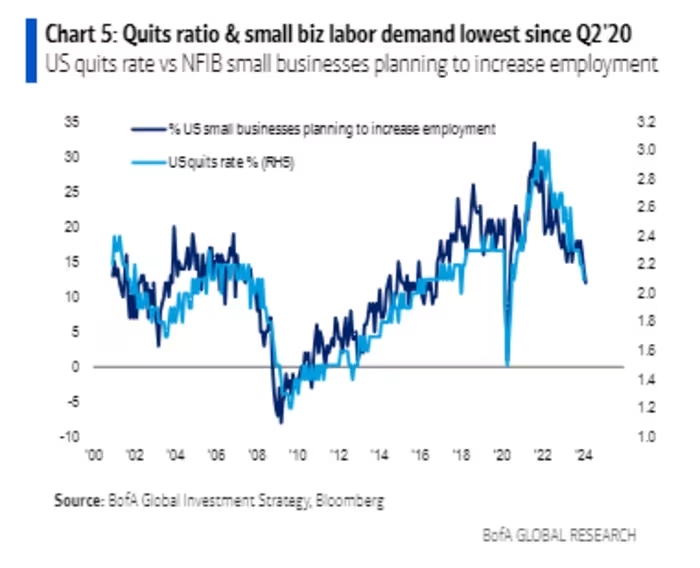

Despite government data showing strong job creation, there’s been a decline in full-time employment over the past three months. Additionally, fewer workers are quitting their jobs, and small businesses are scaling back hiring plans, indicating labor market challenges.

Compounding these issues, rising government spending has led to increased budget deficits, potentially pushing Treasury yields above 4.5% for the first time since late last year. This could exacerbate pressure on U.S. stocks, which have been faltering in recent weeks.

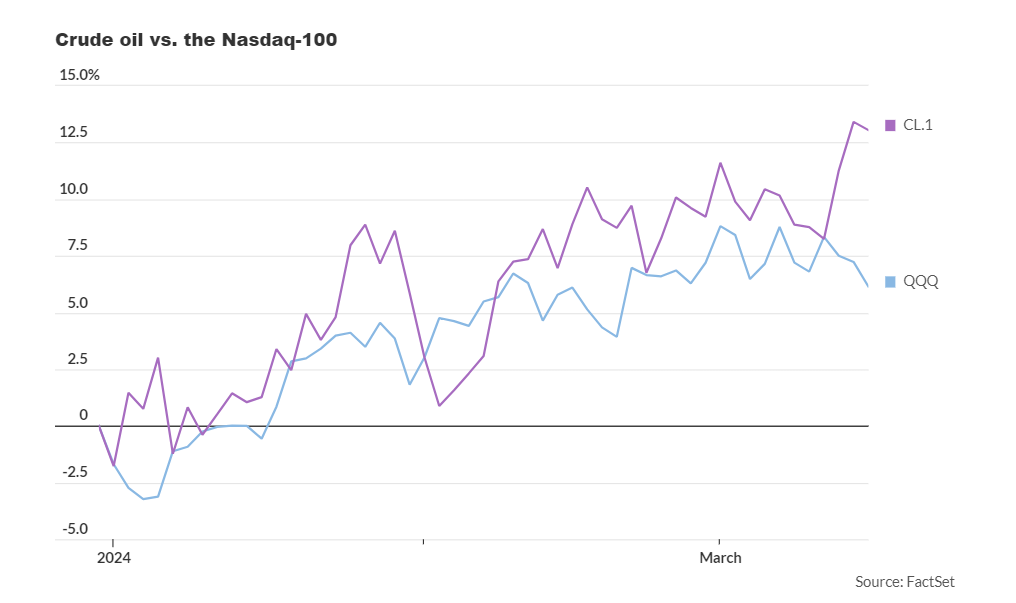

In such an environment, commodities, gold, cryptocurrencies, and cash are likely to become more attractive investments, while the equity market landscape may undergo significant changes. Hartnett suggests that a portfolio emphasizing resources and defensive assets could outperform traditional stock investments.

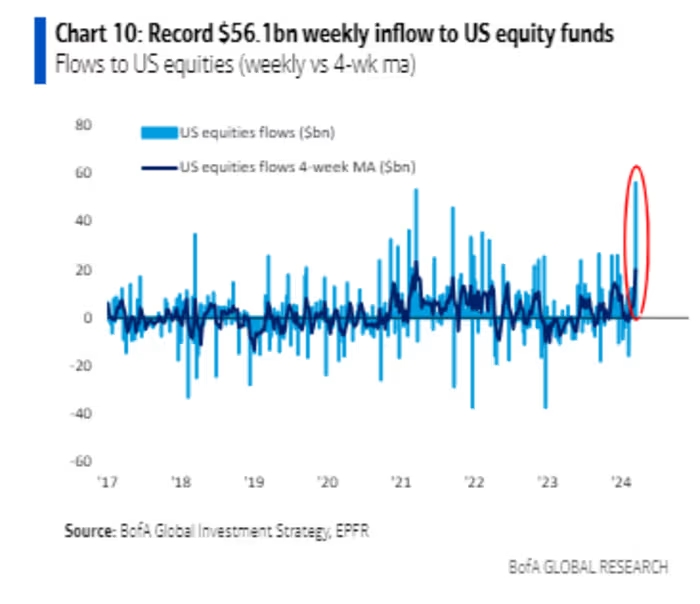

Indeed, there are early signs of this shift, with crude oil prices outpacing tech-heavy indices like the Nasdaq-100 since the beginning of 2024. However, despite these warnings, investors continue to pour funds into U.S. equity markets, indicating a reluctance to abandon stocks entirely.

Hartnett’s concerns echo those of other Wall Street analysts, including Marko Kolanovic of JPMorgan Chase, who recently highlighted the potential transition from a ‘Goldilocks’ economy to stagflation reminiscent of the 1970s.

[ad_2]

Source link