[ad_1]

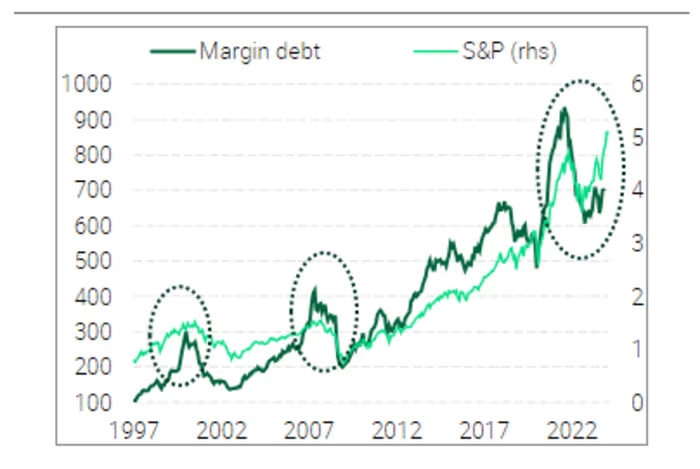

The absence of a significant element seen at nearly every previous peak bubble suggests that U.S. stocks are not currently in a bubble, according to analysts at TS Lombard. Unlike past bubbles, the current market lacks substantial leverage. Despite appearing overvalued, with technology stocks notably high compared to historical averages, margin debt has scarcely increased since the recent bear market ended in October 2022.

Additionally, the ratio of margin debt to the market capitalization of the S&P 500 has actually decreased as stocks have risen.

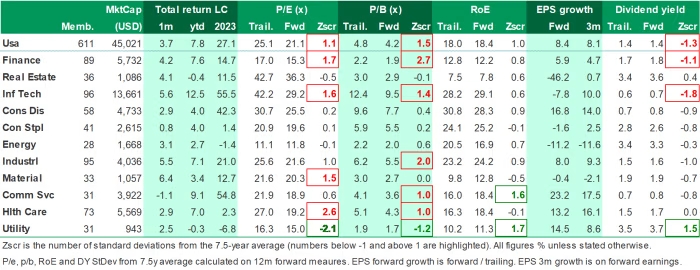

While valuations are elevated, particularly in sectors like technology, financial, and healthcare, they are supported by robust earnings growth, especially among major corporations.

The market’s concentration on a few mega-cap companies like Nvidia, Apple, Microsoft, Amazon, Meta Platforms, and Alphabet has driven significant appreciation in their market capitalization, leading to a more concentrated market reminiscent of the dot-com era.

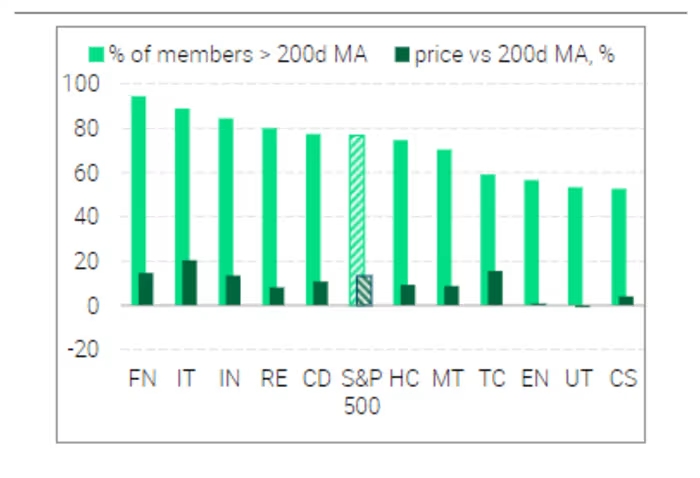

Despite concerns about leverage, other indicators, such as the breadth of the market, have shown signs of improvement. However, there are still debates about the role of options trading in driving stock prices higher, with TS Lombard noting that recent volumes remain below levels associated with previous market bubbles.

This perspective aligns with other analysts, including Ray Dalio of Bridgewater Associates, who recently argued against the notion of a stock market bubble. As markets rebounded from a tech-led selloff, U.S. stocks showed resilience, with the S&P 500 and Nasdaq Composite both trading higher.

[ad_2]

Source link