[ad_1]

Key Information for the U.S. Trading Day

The U.S. trading day after the holiday shows signs of nervousness, particularly with Big Tech stocks like Nvidia seeing a dip before the market opens, ahead of eagerly awaited earnings reports.

Market analysts, including Joe Adinolfi from MarketWatch, suggest that Nvidia’s earnings could potentially dampen market momentum due to optimistic investor expectations.

A cautionary note comes from Ed Yardeni, president of Yardeni Research, who warns that not only enthusiastic investors but also Wall Street analysts themselves could contribute to market volatility. Yardeni highlights the phenomenon of a feedback loop, wherein rising stock prices prompt analysts to revise their estimates for company revenues, earnings, and profit margins upwards, fueling further stock price increases.

Yardeni emphasizes that trying to resist market trends often leads to dissatisfaction among followers and asserts that this behavior resembles mob psychology more than sound financial analysis.

While Yardeni generally holds a bullish outlook, he prefers a more steady market that is supported by underlying fundamentals. He expresses concerns that excessive optimism fueled by the feedback loop could lead to a market meltup, typically followed by a meltdown.

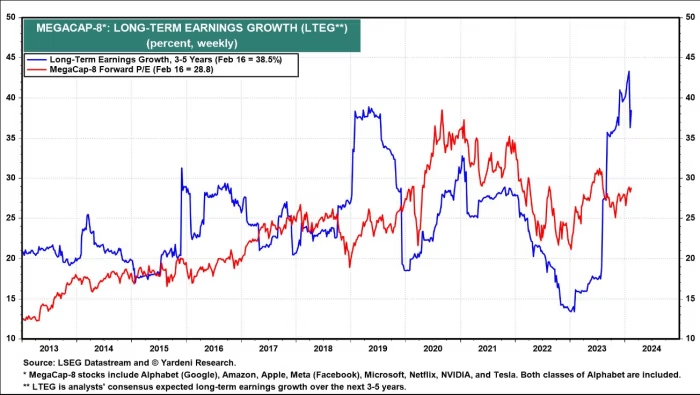

Analyzing long-term earnings growth (LTEG) data for S&P 500 companies, Yardeni and his team find that analysts tend to be overly optimistic about the future earnings prospects of the companies they cover. Historical LTEG peaks, such as those seen during the late 1990s tech bubble and after the 2018 corporate tax rate cut, serve as cautionary examples.

Yardeni also examines LTEG for the MegaCap 8 stocks, including Alphabet, Amazon, Apple, Meta, Microsoft, Netflix, Nvidia, and Tesla. These stocks, accounting for a significant portion of the S&P 500’s market capitalization, have seen substantial LTEG increases recently, particularly Nvidia.

The latest data show Nvidia’s LTEG soaring from 21.2% to 102.5%, contributing significantly to the overall MegaCap 8 LTEG increase, which settled at 38.5% in the latest available figures.

[ad_2]

Source link